Fund manager Artemis is a British success story. Set up 27 years ago, it oversees £26 billion of assets on behalf of investors.

Although it’s very much an ‘active’ investor, with fund managers responsible for the portfolios they construct, nearly 10 per cent of its money is managed in a more methodical way.

It’s run according to a system called ‘SmartGARP’ – GARP stands for ‘growth at a reasonable price’.

The portfolios of the four funds managed in this way – UK Equity, European Equity, Global Equity and Global Emerging Markets Equity – are constructed on the results of data that a vast in-house computer programme processes every day on individual companies.

Everything from profits, cash flow, revenues and dividends through to forecasts.

In simple terms, the computer scores companies out of 100: the higher the score, the more investible a company is.

Two managers, Philip Wolstencroft and Raheel Altaf, ultimately decide the constituents of the funds, but they are directed by what the computer tells them.

‘It replicates the work of thousands of analysts,’ says Altaf. ‘By investing in financial data, including niche and novel ones, we have a system that gives us an edge in the company insights it provides.

‘Our role is to use the information to best effect, building portfolios that are diversified across sectors and companies.’

He adds: ‘As the GARP label implies, the aim is to have a portfolio of companies which we have not overpaid for and which we will make money for our investors from as their growth is reflected in ever higher share prices.’

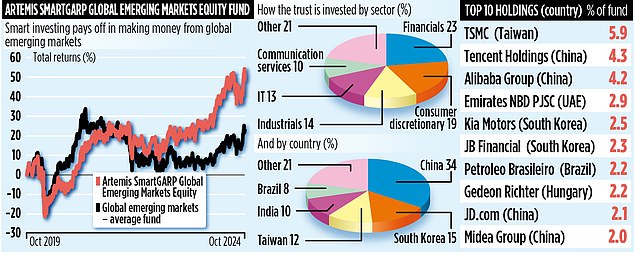

The strategy has proved most effective on Global Emerging Markets Equity, accounting for £1 billion of the £2.5 billion of assets managed this way.

Over the past five years, it has generated a 47.5 per cent return, way ahead of the average for its peer group of 20.3 per cent.

Altaf says the computer analyses data on 3,000 emerging markets stocks, with the fund comprising companies drawn from the ‘top’ 10 per cent of businesses which have been given the highest scores.

The fund currently has 80 holdings. If a company’s score improves, more shares are usually bought. Conversely, if it starts to fall, positions are slowly unwound.

‘It’s a data-driven approach,’ says Altaf, ‘which means it doesn’t fall victim to the swings in sentiment commonplace in emerging markets. Swings that often result in investors selling on the first hint of trouble, such as trade tensions or geopolitical risks. Our fund keeps investing in the best companies.’

Altaf says the finished product is a fund where the overall holdings are undervalued compared to its benchmark, the MSCI Emerging Markets Index – yet where analysts’ forecasts are more positive. In other words, there is potential for stellar share price growth.

Its holdings also have stronger returns on capital than the index and more cash available to pay shareholders a decent dividend. The fund currently offers investors an attractive yield of 4.9 per cent.

‘Many companies in China and South Korea have learnt lessons,’ says Altaf. ‘Instead of expanding, they now focus on strengthening their balance sheets. This results in better cash generation and strong dividends for shareholders.’

Altaf, who has been at the helm of Global Emerging Markets Equity since its launch in April 2015, adds: ‘Every company in the fund is there because of sound fundamental analysis by SmartGARP. It’s a system that will outlive me, that’s for sure.’

The fund has overall ongoing charges of 0.86 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .