Global dividends are in a sweet spot and according to recent research from asset manager Janus Henderson they are poised to increase by 6 per cent next year.

It’s a view that the manager of investment fund Aegon Global Equity Income shares. Mark Peden says there is currently a ‘deluge’ of dividends across global stock markets. ‘We’re enjoying a decade of dividends,’ he says.

Peden is a fervent believer in global equity income investing. He set up the Aegon fund 12 years ago and it has been a resounding success, delivering an attractive mix of income and capital return.

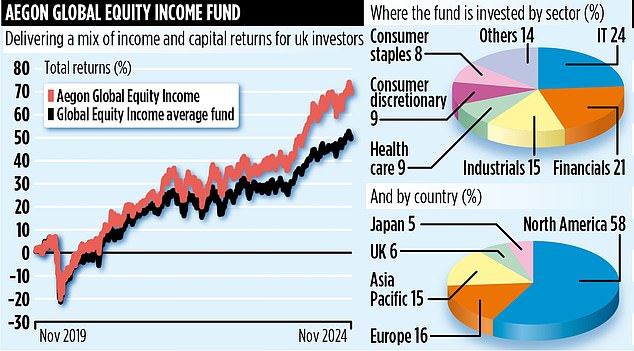

Over the past five years, the £690 million fund has delivered an overall return of 68 per cent, compared to the average for its peer group of 50 per cent. Over the past year, the respective figures are 23 and 18 per cent.

‘It’s a simple investment proposition,’ says Peden. ‘It’s global with the fund invested across 14 stock markets. The fund is fully invested in equities – a plain vanilla portfolio with no use of derivatives.’

He adds: ‘And the income is delivered from companies that tend to be big beasts of the stock market – household names with strong balance sheets and good returns on equity. If a company doesn’t pay a dividend, it won’t get into the portfolio.’

The fund comprises 49 holdings, with the portfolio skewed towards the US (58 per cent). It also has a significant slice of its assets in Asia Pacific where companies are becoming more focused on generating income for shareholders.

For a stock to get into the fund, it must get through at least four of the six filters Peden applies – built around the quality of the current dividend it is paying and its sustainability. ‘We want companies which are going to increase their dividends,’ Peden says.

He says there are three types of income-friendly stock which make up the fund’s portfolio. Typically, half of the fund comprises dividend ‘compounders’ – companies which have longstanding records of paying shareholders a growing income, year in and year out. These include the likes of US insurer Cincinnati Financial Corporation, global energy giant Schneider Electric and multinational chemicals company Linde.

The other half is made up of ‘hoarders’ and ‘de-equitisers’. The former are companies that are currently under-distributing dividends to shareholders – and look as if they will reverse that trend. The latter include businesses which have the scope – for example, through reorganisation of their balance sheets – to buy back shares, increasing the dividends available to remaining shareholders.

This three-pronged approach produces a portfolio different from most other income-oriented global funds – with sizeable exposure to big tech companies such as Microsoft (its biggest holding) and Taiwan Semiconductor Manufacturing Company. Such companies, says Peden, offer the potential for an exciting mix of high dividend growth and strong share price gains.

The income strategy at Aegon has proved so successful that the fund is sold worldwide – with an additional £400 million of funds managed in identical fashion. Peden is supported by four other investment managers and analysts.

The dividend the fund pays is equivalent to an annual income of 2.2 per cent with investors receiving payment quarterly. Fund charges are attractive at 0.64 per cent. ‘This fund is my baby,’ says Peden. ‘I’ve got a lot of my pension invested in it.’

Rival global equity income funds that get the thumbs up from ratings company FundCalibre include those run by Evenlode, Fidelity, Guinness, JPM, M&G and Redwheel.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .