Bitcoin has surged to a new record high as Donald Trump declared victory in the US presidential election.

The digital currency soared to $75,397 this morning, topping its peak of roughly $73,000 dollars set in March.

It comes as Trump promised on the campaign trail to make the United States the ‘crypto capital of the planet’ – despite hesitancy during his first term in office.

Trump previously described cryptocurrency as a scam but has now radically changed his position and has a significant stake in the digital currency himself.

In September, the Republican candidate launched his family’s own cryptocurrency venture, World Liberty Financial.

But it had a faltering sales launch earlier this month, with only a small proportion of the tokens it put on the market finding a buyer.

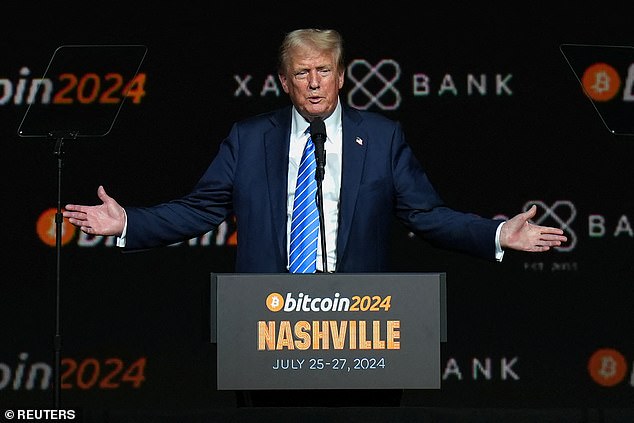

Donald Trump gestures at the Bitcoin 2024 event in Nashville on July 27

Donald Trump smiles at an election night watch party at the Palm Beach Convention Center

Donald Trump makes a campaign stop at Pubkey Bar and Media House on September 18

Prior to the election, many crypto proponents argued that a victory for the former president would be good for the currency.

Some analysts predicted that a Trump victory could cause Bitcoin to surge to as much as $80,000 or $90,000.

Nigel Green of deVere told The Guardian before the vote: ‘A Trump victory could be the catalyst that pushes the world’s first and largest cryptocurrency into uncharted territory.

‘His return to office would likely have a renewed emphasis on deregulation, tax incentives and economic policies favourable to alternative investments, such as Bitcoin.’

In the second half of his presidency, Biden has clamped down on crypto companies in an effort to curb security violations – raising questions about the currency’s future in the US.

It comes as global stock markets also surged as Fox News projected the Republican nominee had won the presidency, defeating Kamala Harris.

London’s stock market rose 0.9 per cent, Paris climbed 1.0 percent and Frankfurt advanced 0.8 percent as they rallied at the start of trading this morning.

Trump was joined on stage by family – including daughter Ivanka and son-in-law Jared Kushner who had been absent from the campaign – aides and political supporters

Republican presidential nominee former President Donald Trump makes a campaign stop at Pubkey Bar and Media House on September 18

Analysts generally assume Trump’s plans for restricted immigration, tax cuts and sweeping tariffs if enacted would put more upward pressure on inflation and bond yields, than Democrat Harris’s policies.

This morning US Treasury yields shot to four-month highs and the dollar surged – putting it on track for its best one-day gain in over two years – while U.S. equity futures were up almost 2 per cent.

In early European trade, concern that higher tariffs under a Trump presidency could deal the region’s economy a fresh blow pushed the euro down 1.7 per cent to $1.074.

While euro zone government bond yields fell sharply with German two-year bond yields down 10 basis points at 2.19 per cent.

Money markets priced in lower European Central Bank rates meanwhile.

‘For European businesses, Trump’s return to the White House would mean considerable trade policy and geopolitical uncertainty, with negative implications for growth on the continent,’ said Berenberg chief economist Holger Schmieding.

Supporters arrive at an election night watch party for Republican presidential nominee former President Donald Trump

Supporters of former US president and Republican presidential candidate Donald Trump cheers near his Mar-a-Lago resort in Palm Beach

Euro zone stock futures however rose sharply, tracking their U.S. peers.

Japan’s Nikkei surged over 2.5 per cent as the yen slid, while MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.9 per cent.

While markets were still confident the Federal Reserve will cut interest rates by 25 basis points on Thursday, futures for next year eased into the red with December down 9 ticks.

Yields on 10-year Treasury notes jumped to a four-month high of around 4.47 per cent, from 4.279 per cent, breaking last week’s top of 4.388 per cent. Two-year yields climbed to 4.31 per cent, from 4.189 per cent late in New York.

‘If we look at the long end of the curve, that reflects the fact that both candidates are not exactly fiscal conservatives, they’re both willing to use the fiscal printing press,’ said Arnim Holzer, global macro strategist at Easterly EAB Risk Solutions

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .