- Chinese manufacturers are challenging Tesla’s dominance

There are various factors behind the poor performance in the shares of this member of the Magnificent Seven of tech.

Growing competition has compelled the £535billion electric car maker – run by Elon Musk – to slash prices globally. As a result, the company’s second quarter profits were disappointing.

Chinese manufacturers, such as BYD and Geely, are challenging Tesla’s dominance – especially in China, the world’s largest EV (electric vehicle) market.

In Europe, BMW has overtaken Tesla in the EV sector. BMW may hold on to this advantage following the imposition by the EU of a 9 per cent duty on cars made in China – where 51 per cent of Tesla’s output is manufactured.

How does Tesla compare?

The prices of these titans were rocked in the rout earlier this month. But the other members of the gang have revived. Nvidia, the name behind the microchips that power generative AI (artificial intelligence) has now risen by 169 per cent since the beginning of January.

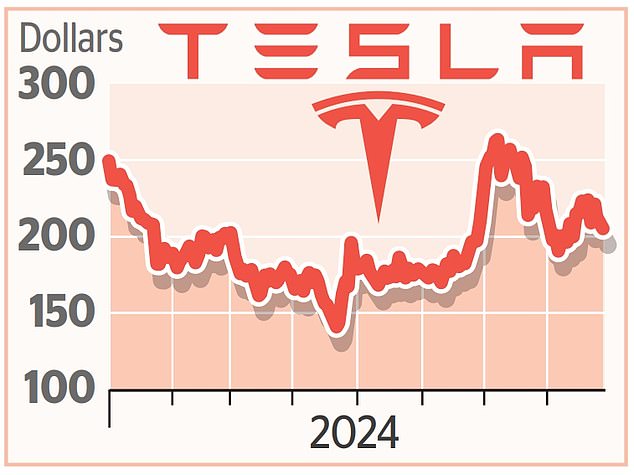

Tesla’s decline in 2024 should be seen in context, however. Shares in the company, which Musk has led since 2008, stand at $220. This is 1463 per cent above their level of 2019.

In 2013 when the high-risk Scottish Mortgage investment trust began to buy Tesla stock, the price was $11.

The shares reached a peak of $407 in November 2021.

How is Musk fighting back?

Musk says autonomous ‘robotaxis’ – their debut is promised for October 10 – could turn Tesla into a $5 trillion company, although views differ on this pledge.

Musk polarises opinion. Some regard him as the greatest commercial genius of our era, while others argue that he has become a threat to all his ventures, including Space X and Twitter, now known as X.

But there is universal assent that he has been the driving force behind Tesla’s ascent and must now tackle its problems.

As the recipient of a $56billion (£44billion) pay package, it is the least he can do, although he may be even more stretched than before if Donald Trump becomes president.

Musk has endorsed Trump and could act as an adviser, although a slot in the cabinet has been ruled out.

Are the shares worth buying?

Just seven of the 47 analysts that follow this stock recommend that investors sell. Another 20 rate the shares a ‘hold’, while 11 consider them a ‘buy’.

One reason for this confidence is Tesla’s energy storage business which is seen as a juggernaut in the provision of the batteries essential for clean energy.

Tesla’s futuristic-looking $100,000 cyber-truck may make headlines. But batteries will arguably play a greater role in its future.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .