The investment trust Rockwood Strategic is a rare breed: A fund that buys some of the UK’s smallest listed stocks whose shares are bombed out in the expectation of them bouncing back.

It’s an investment strategy that requires lots of due diligence and the hand-holding of companies it goes on to own.

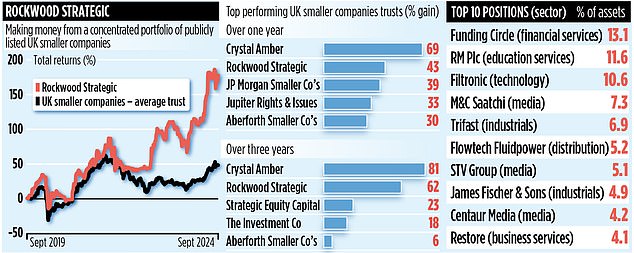

But it works a treat, judging by the performance numbers. Over the past one, three and five years, it has delivered total returns of 43, 62 and 167 per cent.

To contextualise these figures, the average UK smaller companies trust has recorded respective returns of 20 per cent, a loss of 9 per cent and 46 per cent.

Excitingly, manager Richard Staveley believes this run of good investment form can continue, helped in part by the continued compelling valuations of many companies in the sector of the UK stock market he focuses on – and the prospect down the track of lower interest rates (which is good for UK businesses).

He says: ‘I view what I do as hunting for truffles in a big forest. I’m constantly searching for investment gems, businesses that are chronically undervalued and unloved – but where I see there is an opportunity for a big turnaround and a future rerating of the share price.’

Stock selection is key – the trust has only 22 holdings, with the top ten positions accounting for nearly three-quarters of the assets.

Although Staveley says his approach is one honed over 25 years of involvement in fund management, he also draws upon the wisdom of legendary investor Warren Buffett.

‘Buffett opines on the value of running concentrated investment portfolios,’ explains Staveley.

‘He also encourages investors to avoid market hype and take emotion out of the investment equation. These are all things I do.’

Staveley targets companies that have market capitalisations of less than £250million – often referred to as ‘micro-cap’ stocks. It’s a space of the market that few fund managers are interested in.

He says: ‘It’s an inefficient part of the UK market, which means opportunities abound.

‘I find companies that are mispriced by the market, have business problems that they have not yet addressed – and then I encourage them to carry out the things they know they should do to turn themselves around.

‘Hopefully, over a three-to-five-year period, the result will be a recovery in profits and a rerating of the shares.’

The encouragement that Staveley talks about is helped by the fact that in 15 of the holdings, the trust owns more than five per cent of the shares. This allows it to call extraordinary general meetings (EGMs) to push for changes that it believes will improve the fortunes of a company.

Recent success stories include a stake it bought in lending platform Funding Circle early this year.

Staveley says: ‘The company listed on the UK stock market six years ago with a £1.5billion valuation. When we bought the shares in January this year, it was £130million and rival fund managers had lost interest in the company.

‘But, encouraged by us, the business has cut costs, sold loss-making operations, made boardroom changes and bought back shares.’

Over the past six months, Funding Circle’s shares have jumped by more than 386 per cent.

Staveley, who works for the investment house Harwood Capital, owns shares in Rockwood Strategic, giving him ‘skin in the game’ – so he has a personal interest in delivering stellar returns.

Ongoing annual charges are 1.2 per cent (source: Hargreaves Lansdown) and the trust’s stock market identification code is BRRD5L6. The market ticker is RKW.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .