Steven Fine does not mince his words on the Budget – especially when it comes to capital gains tax (CGT).

Rachel Reeves is reportedly planning to increase CGT on shares in the Budget by ‘several percentage points’ from the current rate of 20 per cent.

That is hardly what Britain needs if it is to encourage ‘risk taking and investment’ says Fine, chief executive of City broker Peel Hunt.

‘Tax rises like this would send the opposite message to entrepreneurs everywhere as well as investors in our capital markets,’ he says.

He urges the Chancellor ‘not to take such a damaging step and choke off investment’.

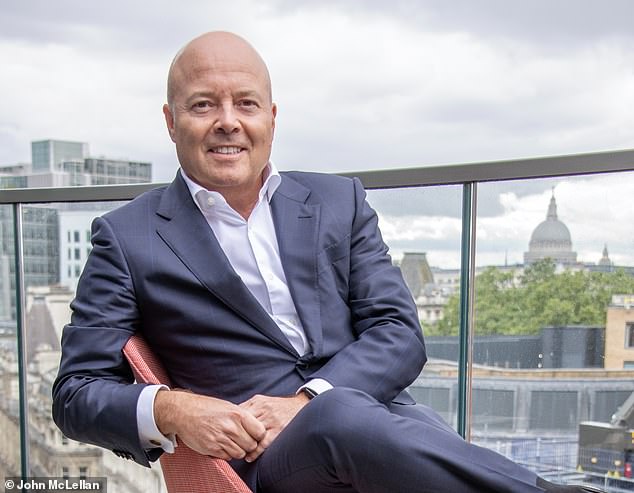

Budget worries: Steven Fine (pictured), boss of City broker Peel Hunt, has warned that hiking capital gains tax will strangle investment

CGT is levied on the profits of selling assets from shares to second homes – at different rates depending on the type of asset.

City figures such as Fine warn increasing the levy would erode the attractiveness of backing growing British companies.

‘What is the point of investing,’ asks Fine, if the gains made for the risk of doing so are taxed so highly.

It is one of the reasons why, as Fine says, the Reeves’s debut fiscal set piece later this month has the financial world on tenterhooks.

‘I’ve never known as much anticipation or expectation around the Budget probably in my career,’ says Fine, 58, who is married to Jacqueline, and has three children and four grandchildren.

He suspects that the Chancellor’s dire warnings as to what the Budget may contain could be a case of expectation management. If so it ‘might be a bit too clever’, he fears.

Peel Hunt advises 145 public companies worth a total of £125billion. Four of them are in the FTSE 100 and 42 in the mid-cap FTSE 250.

It is what Fine says puts his firm in the ‘engine room of the UK economy’ – more so than rivals focused either on just the FTSE 100’s multinationals or purely small-cap stocks at the other end.

But it has been a tough time for the sector – amid a dearth of deals and stock market listings that in healthier times provide them with lucrative fee income.

Worries about what Reeves will take out of her red box on October 30 are only making that worse.

‘It’s had a huge impact. You can see the slowdown in activity ahead of what may or may not happen in a Budget that has been hotly anticipated the most maybe in a couple of generations. I think that’s led to a sort of pause on markets.’

And it has interrupted what had been shaping up to be a comeback for the City, Fine says. ‘I genuinely do believe we are in a new cycle,’

he adds. ‘We’re in the early stages of it – it’s probably been going six or seven months and I think if it weren’t for this impending Budget – which at least has a fixed date – you would have a bit more momentum, it’s just taken a hiatus.’

City stalwart: Peel Hunt advises 145 public companies worth a total of £125bn. Four of them are in the FTSE 100 and 42 in the mid-cap FTSE 250

Notably, London’s junior market Aim has underperformed the wider London market by as much as 15 per cent.

The slump came about amid speculation that an inheritance tax break for Aim shares – which was designed to encourage investors to fund smaller British companies – could be axed.

On the other hand, Fine notes, the pound has strengthened, bond markets have been calm, and UK growth has outperformed G7 rivals in the first half of this year – while the Government is also making welcome noises on regulatory reform.

It could be a chance for Britain to ‘reassert itself’.

‘It feels like the stars are aligning,’ he says, ‘but it requires forward thinking which has been lacking over the last few decades.’

Yet Labour’s insistence that it is committed to a growth agenda does not square with the impression that it wants to ‘raise a lot of taxes and stop growth’.

Hence the heightened anticipation ahead of the Budget to see whether – and how – the Chancellor can deliver.

If it does, Fine argues that it could, in a choice turn of phrase, unblock the ‘constipation’ holding up Britain’s pipeline of initial public offerings (IPOs).

Private equity funds’ investors are clamouring to make exits by taking companies to market – but the demand must be there first.

‘Whilst there is no substantial near-term pipeline the potential is probably as good as I’ve known it,’ says Fine. ‘Something’s got to give.’

Fine says his investment bankers are ‘as busy as they have ever been’. He adds: ‘I think they’re working hard on a lot of situations. IPOs are later. That valuation issue has got to resolve itself.’

A lot needs to be done, he argues, including pensions reform – and stopping the ‘horrendous’ outflow of funds from UK equity markets.

Cherishing British achievements and nurturing innovation rather than letting it be swept away by foreign owners is another goal. That could be helped by pension funds investing more in Britain.

He says: ‘I feel passionate about the fact that there should be more of a sense of pride in what we do here in this country.

We’re very, very good at an awful lot of things, we talk ourselves down a lot – we’re world class at moaning, it’s probably a function of the weather.’

So much depends on the Budget –including what is not in it, such as the CGT changes.

‘It may be a damp squib, it may be an astonishing revelation of packages that will transform the view of the UK,’ he says.

The temporary blip in market activity in anticipation of the Budget will all be forgotten if the latter proves to be the case. A three-month slowdown ahead of what could be a gigantic pick-up would be fine.

We’ll look back on it and think “so what?”. But a three-month slowdown because you can’t do what you been elected to, or said you would, do for whatever reason is going to translate into another lengthy period of inactivity.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .