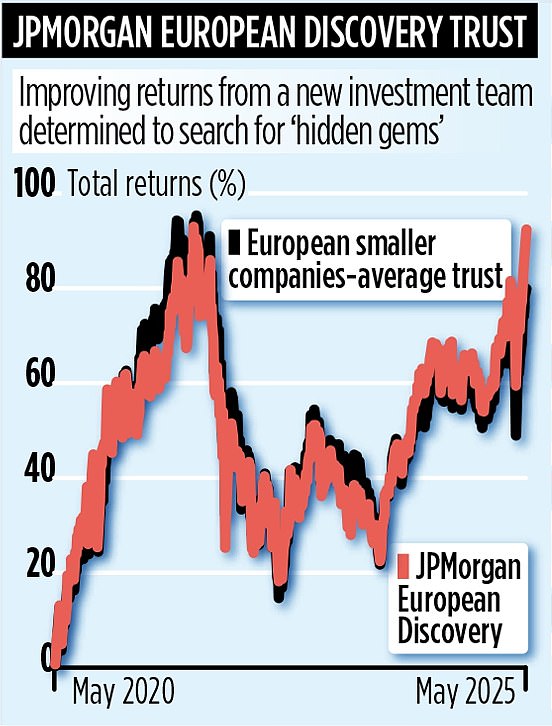

Investment trust JPMorgan European Discovery has been through the wars recently, yet this smaller-companies fund now seems back on track.

Last year, poor performance against its benchmark index and a struggling share price attracted the attention of trust predator Saba Capital which, at one stage, had a 13 per cent stake in the business.

But the board of the stock market-listed fund headed off potential trouble by making changes. While keeping JP Morgan Asset Management as investment managers, it demanded a shake-up of the team.

This meant the departure of long-standing managers Francesco Conte and Edward Greaves, and the arrival of Jules Bloch, Jack Featherby and Jon Ingram.

So far, the change has worked with the £543 million fund having a good past year, delivering total returns of 16 per cent. To put this figure into perspective, its peer group has generated an equivalent gain of 11 per cent.

Just as importantly, Saba seems to have lost interest in the trust, reducing its stake to 4.5 per cent. Some shareholders also took the opportunity of a tender offer late last year to redeem their holdings on favourable terms.

Bloch insists that the trust’s focus on European smaller companies enables him and his two colleagues to make money from an ‘exceptional asset class’.

It invests in a universe comprising companies with market capitalisations of between €450 million (£380 million) and €10 billion (£7.45 billion).

‘The trust has no UK stocks,’ he says, ‘and there are no constraints in terms of its exposure to specific sectors or countries across Continental Europe. We are able to discover some hidden gems which many investors haven’t heard of before – and in turn are hugely profitable and can grow.’

He adds: ‘When companies break through €10 billion we will run with them although we would sell if their market capitalisations approached €15 billion.’

Italian bank Unipol Gruppo, a top-ten fund holding, fits into this category. Although there are three managers at the trust’s helm, they’re assisted by heaps of quantitative analysis. This sifts the trust’s 2,600 company-strong universe, discarding un-investible stocks (not liquid enough) and ranking companies according to tried-and-tested investment criteria: value, quality and (share price) momentum.

The top 400 form the pool from which the team select stocks for the trust’s portfolio. Currently, the fund comprises 78 holdings with the biggest position in French technical company SPIE at 3 per cent. ‘We work as a team,’ says Bloch. ‘We sit together, have regular Monday meetings, and if we disagree about the merits of a potential new holding, then we tend to opt for the stake recommended by the least enthused.’

He adds: ‘What I love about the companies we invest in is that many are mature businesses which are growing.’

Among them is Puuilo, a Finnish DIY chain. ‘It has 45 stores,’ he says, ‘and it wants to get to 75 by opening a new one every two months. It is well managed and while in growth mode it’s keen to return cash to shareholders.’

The trust, formed 35 years ago, changed its name four years ago – from European Smaller Companies. Although the investment focus is very much on capital growth, it does pay a dividend. In the last full financial year, it distributed income of 10.5p a share – paid half yearly – with the shares currently trading at around £5.37.

The stock market identification code is BMTS0Z3 and the market ticker is JEDT. Annual charges total 0.92 per cent.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .