Britain’s longest-serving bank boss said the now-scrapped EU cap on banker bonuses resulted in ‘grotesque’ levels of pay – as his own earnings hit a record high last year.

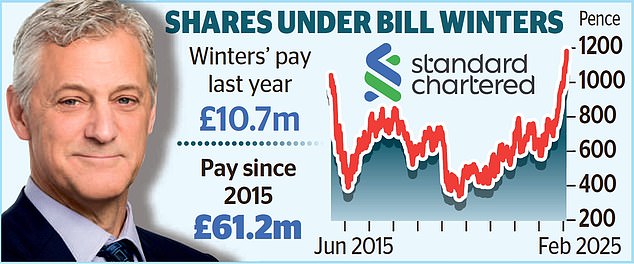

Bill Winters, 63, chief executive of Asia-focused lender Standard Chartered, was paid £10.7m in 2024, including £7.6m in bonuses and share awards – a 46 per cent increase on the prior year.

It means he has been paid more than £61m since taking the top job in June 2015.

Winters seems set to make even more this year as the bank unveiled plans for his package to be lifted to a maximum of £13.1m if he hits his targets.

That would come despite a 40 per cent cut to his basic pay following moves by other banks, such as HSBC and Barclays, to take advantage of the lifting of the UK’s cap on banker bonuses.

Winters defended the move yesterday, saying the cap – brought in by the EU after the 2008 financial crisis – created the wrong incentive. ‘Everybody that was subject to that cap got a grotesque increase in fixed pay and a reduced opportunity to earn a multiple through bonuses,’ he said. ‘It incentivised managers in my position to hang around and clip coupons and not do a very good job,’ he added, using an American term akin to the British ‘pen-pushing’ to describe laziness.

But he joked the reduction in basic pay meant he would need to ‘explain to my mother why my salary’s been cut by half’.

The Standard Chartered boss has previously butted heads with shareholders over pay. In 2019, he described investors who had protested about his compensation as ‘immature’.

Standard Chartered shares hit their highest in more than a decade after strong results, nearly doubling over the last year in a boost for Winters, who in February last year branded the share performance as ‘crap’.

The bank posted a pre-tax profit for the year of £4.8billion for 2024, an 18 per cent increase on the prior year. It also reported a better-than-expected haul of £8.2billion from net interest.

The lender unveiled plans for a £1.2billion share buyback – and shares rose 3.8 per cent, or 43p, to 1183p yesterday.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .