Rachel Reeves has a problem – and it’s now bigger than the one she inherited as Chancellor.

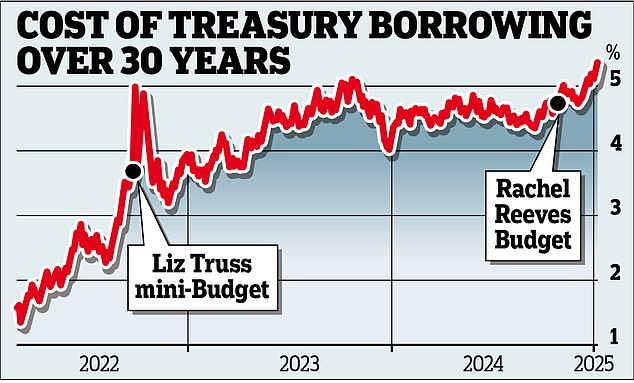

The UK’s borrowing costs have been climbing since the Chancellor’s Autumn Budget and 30-year gilt yields have reached the highest level in 27 years.

Reeves and Sir Keir Starmer squandered the optimism they were blessed with by a change of government, bizarrely opting for miserabilism instead.

They talked up a supposed £22billion black hole and talked down the economy, then delivered a set of anti-growth tax rises.

Meanwhile, we live in a country where public services are a mess and after years of underinvestment it can often feel like nothing works properly.

In a nutshell, we can’t fix Britain and deliver the improvements and support we need for future growth because we don’t have the money and need to borrow to fund it.

It’s not a great time to be doing that from international investors, as Britain is far from the only nation with this problem, and the issue is compounded by the UK’s self-inflicted dent to business and market confidence.

Against that backdrop, it’s hardly surprising that the UK’s borrowing costs have risen. (Read our guide on gilt yields and why they are up.)

Ten-year gilt yields are at 4.8 per cent, compared to 3.8 per cent a year ago. Meanwhile, the 30-year gilt yield garnering headlines in recent days is at 5.36 per cent, compared to 4.42 per cent a year ago.

Not all of this is Reeves and Starmer’s fault. Some of it is down to a readjustment of global interest rate expectations, with potentially the pendulum swinging too far.

But Labour’s Gloom Twins are to blame for some of it: talking down the economy, sending confidence plummeting, and then hiking taxes on investors, businesses, employment and wealth was a daft tactic.

The rise in borrowing costs is particularly unfortunate considering Labour’s relentless attacks on the Conservatives over Liz Truss sending gilt yields soaring.

It’s worth noting that this isn’t the same scenario – gilt yields have steadily climbed rather than shooting up – and that Truss and Kwasi Kwarteng’s bodged mini-Budget was definitely not a success.

Too much was unveiled in one reckless and unfunded swoop, the moves came without OBR costings, Kwarteng overshadowed his own income tax cut for all with a tax cut for the highest earners, and they failed to take into account the ructions that could be triggered in the bond market by too-clever-for-their-own-good pension fund investments.

The list doesn’t stop there and our current predicament was also triggered by Jeremy Hunt’s fun police act after the mini-Budget, when as Chancellor he didn’t just reverse the tax cuts but hiked taxes and further skewed Britain’s warped tax system.

However, the calamitous end to the Truss-Kwarteng gamble doesn’t mean that they were entirely wrong.

They identified the UK’s persistent low growth as a problem and wanted us to radically change our thinking enough to shake Britain out of its funk – and for the economy to achieve escape velocity.

Reeves and Starmer broadly agree with that; Labour’s manifesto and campaign had a similar growth-focussed sentiment.

The Gloom Twins: Sir Keir Starmer and Rachel Reeves doubling down on miserabilism, talking down the economy and talking up our problems has come back to bite them

The problem is that it’s all very well promising growth but once in power reality hits: we need to speculate to accumulate but we don’t have the capital to do that.

The alternative is to borrow, but we already have a colossal debt pile and investors want higher rates to lend to us, which further hampers the UK’s finances.

This is something that the IFS’s Paul Johnson has referred to as a ‘fiscal doom loop’.

He says: ‘The trouble is that with high debt, higher interest rates and low growth we risk being stuck on a treadmill, or in a “doom loop”.’

Except, it’s not quite true to say we don’t have the capital to get Britain back on track.

The government represents the UK and its people and some of those people are sitting on a lot of money.

The FCA reckons that total UK cash savings stand at about £1.5trillion. Some of that will be much-needed rainy day pots and other short-term savings, but the FCA has also identified a large amount of it is money sitting in low-rate accounts and a good chunk of it could be invested instead.

Britain’s retired investors also collectively have a large amount in their pension pots, which are needed to fund retirement.

Cash savers and pension investors in retirement tend to be pretty cautious. They want good returns, but they also prize them being reliable and from a low-risk source.

Perhaps the answer to unlocking the UK’s growth conundrum is to offer that to them.

The government could launch Back Britain Bonds offered to ordinary savers and investors.

Sold in a more easy-to-access and understand way than gilts, these would be long-term, 10, 20 or 30-year bonds that paid a guaranteed rate of return with your money back at the end, or perhaps on death.

In this way they would be distinct from fixed savings accounts, which tend to between one and five years maximum.

They would also differ from annuities, which pay out an income for life but with the sum invested gone at the end.

The rate on Back Britain Bonds could therefore be lower and so shouldn’t torpedo the annuity market but instead add extra choice for retirement savers who crave a stable, guaranteed income.

A plan like this would allow us to bypass fickle international investors and tap into the deep pool of very patient capital that the UK’s cash savers and retirement investors represent.

Instead of paying institutional and international investors to borrow, we would pay interest to our own savers and investors, who would welcome a gilt-type yield and provide a much more stable investment base.

The money could then be ring-fenced in a way that guarantees it is not used for day-to-day spending needs but only for materially improving Britain in a way constituting investment in our future.

This investment would in turn boost the economy and improve our finances, while also hopefully having a second round benefit from the savers and retirement investors spending some of the income they got on their Back Britain Bonds.

There’s a small risk that markets wouldn’t like it, but we’ve spent too long being fearful of doing what’s right for the UK’s long-term future due to worrying about that.

Tapping up your own nation’s savings to improve things hardly seems like a bonkers plan – and over the long-term investors are far more likely to back a country that sails out of the doldrums.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .