Years ago, when Luke Hickmore was a wealth manager, there used to be a rule of thumb to determine what proportion of bonds investors should hold in their portfolio.

Fast-forward to the present and Luke is now a co-manager of the Abrdn Strategic Bond Fund. Here, since 2010, he has been responsible for managing a portfolio of bonds issued by companies and governments around the world.

And while over those years the bond market has faced a tumultuous time, Luke still sees value in the same rule.

‘Wealth managers used to say that you should hold the same proportion of bonds in your portfolio as your age,’ he says.

‘So, for example, by this rule, at the age of 55 I should be holding 55 per cent of my own investments in bonds and 45 per cent in equities.

‘Of course, this theory is often criticised and is flawed, but so often it works out in the long run.’

Luke adds that he currently holds a smaller proportion of bonds than the formula would advocate. That is because bonds are generally seen as less volatile than shares and therefore are often considered a good option for those who are reaching retirement and may wish to cash in their investments. Luke has no plans to slow down for many years to come so he can afford to keep his risk profile dialled up.

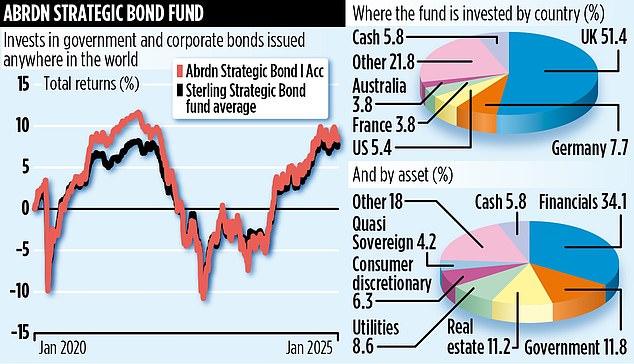

He and his team of three are focused on maintaining a fund that invests in government and corporate bonds issued anywhere in the world. He sees it as a core option for an investor’s portfolio because of its flexibility – it can adapt as market and economic conditions change.

Just over half of the £158.5 million portfolio is invested in the UK, but the team can invest anywhere they choose.

They seek out pockets of value where they believe the market has undervalued investments.

One such area is real estate that benefits from new trends in flexible working.

‘We bought co-working real estate firm Workspace bonds in 2023 when it was really suffering following the pandemic because people were still working from home and the outlook for returning to offices as before was uncertain,’ says Luke.

‘We got a return of 5 per cent above ten-year UK gilts, which amounts to 8.25 per cent overall.’

Luke is also finding value in banks – the likes of Lloyds, Barclays and BNP Paribas. ‘We have been buying debt called contingent convertibles, known as Cocos. These are issued by banks which then, at the end of the duration either buy them back or reissue them. We’re getting yields of around 7 per cent.’

These products cannot be accessed by ordinary investors and can only be bought in a fund. They are risky if a bank runs into trouble, which is why Luke and his team heavily scrutinise their balance sheets and outlooks before jumping in.

Discussions around the outlook for interest rates are core to the team’s strategy. Luke believes there is a chance interest rates could be cut from the current level of 4.75 per cent to 3.75 per cent this year, although it’s hard to call.

And, as investors in bonds, the last thing they want is to be caught out with rates staying higher for longer.

The fund has returned 4.8 per cent over one year and 8.7 per cent over five.

This is compared to a return of 4.6 and 7.7 per cent respectively on average for other strategic bond funds.

The annual charge is 0.6 per cent and the unique stock market identification code is BWK27Z3.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .