It is unlikely the Labour government was thinking about cryptocurrencies when it increased capital gains tax in the Autumn Budget. But I imagine revenue collectors are now eagerly watching the latest leaps and bounds of bitcoin.

Donald Trump’s thumping election victory in the US, and the anticipation of it, have sparked a remarkable surge in the price of the cryptocurrency.

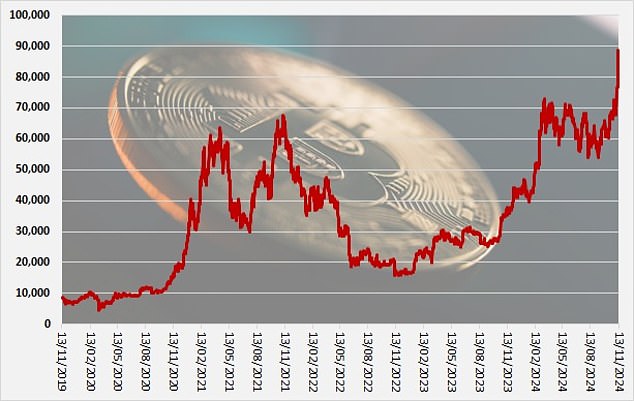

A single bitcoin is worth $92,000 at the time of writing – up 47 per cent in a month.

It is largely born out of hope that the President-elect will relax restrictions on cryptocurrencies.

But this is a longer-term story. Over two years, bitcoin’s value has grown by close to 430 per cent. It is a remarkable capital gain.

Rollercoaster to the moon: Bitcoin investors have reaped big rewards in a Trump melt-up but it’s been a rocky ride for long-term holders

Lots of Britons are feeling the benefit. Crypto ownership increased from 3 per cent to 12 per cent over five years, according to a Yougov gauge last measured in July.

I expect many more people will have joined the throng since then. It is inevitable during a ‘melt up’ in prices.

In the poll, a further 6 per cent told Yougov they don’t know. Perhaps some of the ‘don’t knows’ have bought proxies for bitcoin, such as companies that invest in it, or perhaps have traded on apps that replicate the price.

With only indirect ownership they’re unsure whether to call themselves crypto owners.

HMRC may know about your crypto

The point is that millions of people are invested in crypto and many of them will be sitting on huge profits. Meanwhile, the risk of owing capital gains tax and the rates on it are on the rise.

The capital gains tax rate increased in the Budget with immediate effect – from 10 per cent to 20 per cent for lower rate taxpayers, and from 18 per cent to 24 per cent for those in higher tax bands.

This comes after a sequence of falls in the tax-free allowance, down from £12,300 previously to £6,000 for 2023/24 and then down to £3,000 for 2024/25.

Even before the tax changes and the surge in crypto prices, HMRC had identified an opportunity.

It knows many, many people are using crypto exchanges and even banking apps to profit from crypto gains.

It would appear to have data sharing agreements with businesses that offer such services.

It has, for example, been sending ‘nudge’ letters to individuals that begin: ‘We’re writing to you as our records show you have disposed of cryptoassets.

‘However, you haven’t declared everything correctly. This means you may have tax to pay.’

It also launched a confessional crypto declaration web page last November, urging investors to come clean on profits from previous years.

They would still need to pay any penalties and interest due.

Tax officials can look back 20 years if they believe someone deliberately and wilfully avoided paying.

From 2026, HMRC will receive more data from exchanges through the Crypto-Asset Reporting Framework, an OECD-led initiative.

It is also worth noting that it considers some frequent trading to be liable to income tax. For most crypto fans though, CGT will be the challenge.

Under attack: Investors saw the amount of profits they can make free of capital gains slashed by former Chancellor Jeremy Hunt… then Rachel Reeves hiked the tax rates

Do crypto investors even know they should pay tax?

HMRC’s concern is that, according to its own research from 2022, only 34 per cent of crypto owners said they had a good understanding of CGT; the rest did not understand or had not even heard of it.

Expect more noise from HMRC as we approach the 31 January deadline for submitting self-assessment forms, where tax liabilities are listed and paid.

There are, of course, two common ways to avoid paying tax on your investment gains more broadly – by buying them through a stocks and shares Isa or a Self-Invested Personal Pension, or Sipp.

In crypto, this is not easy.

That is, in part, because the regulatory regime this side of the Atlantic has so far not approved mutual funds for private savers.

In the US, in contrast, there are more than 25 exchange-traded funds, holding billions of dollars, from the likes of Fidelity Investments and BlackRock.

Some UK investors have circumvented this by investing in MicroStrategy, a US software and data company that has a declared strategy of buying bitcoin. It is a ratcheted play on the cryptocurrency – a riskier way to back a risky asset.

Others have chosen Coinbase of the US, a platform for buying and selling cryptocurrencies. Note that Coinbase shares have only just returned to their high of 2021.

Perhaps the lesson – and one that is hard to accept when non-crypto investors are feeling raw FOMO (fear of missing out) – is to understand the risk others are taking in chasing bitcoin higher.

The warning from John Kenneth Galbraith’s The Great Crash 1929 is helpful. He noted speculators’ enduring belief that they can become rich without doing any work.

If that is not enough, then consider the wrangling with the taxman that many crypto speculators will face.

I risk the ire of crypto fans in saying this, but as a steady retirement-focused investor who likes to sleep easy, I’ll stick with the get-rich-slow approach of Isa and Sipp funds that can be safely sheltered from the taxman.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .