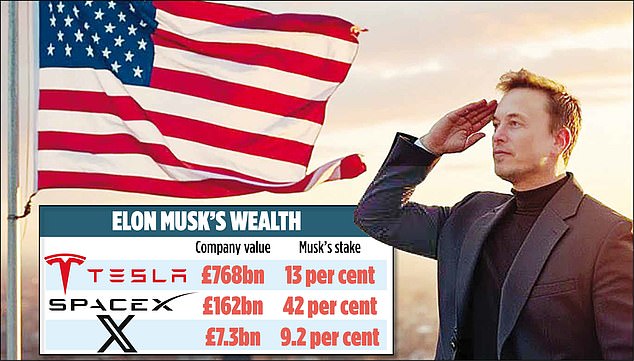

He was easily the biggest winner from Donald Trump’s stunning return to the White House. Elon Musk – already the world’s richest man – saw his personal wealth surge by $26.5 billion (£20 billion) the day after the election as shares in his Tesla electric car company soared on the news.

The tycoon, who also owns social media platform X and rocket maker SpaceX, went all-in on Trump – and scooped the pot. Musk ploughed $130 million into Trump’s campaign, making appearances at his rallies in key swing states and flooding X with messages of support to his more than 200 million followers.

In the 24 hours before the poll, Musk tweeted nearly 200 times, racking up almost a billion views, after averaging 100 posts a day in the month before the vote, according to the Financial Times.

Understandably, Trump was grateful – and fulsome in his praise.

‘He’s a character. He’s a special guy. He’s a super genius,’ the president-elect said of the tycoon in his victory speech.

> How to choose the best stocks and shares Isa and the right DIY investing account

But having made a fortune on his election gamble, Musk stands to gain even more from the incoming administration as Trump – a transactional president if ever there was one – returns the favour.

Trump has pledged to give Musk an official role slashing government spending and red tape as part of a huge programme of de-regulation during his second term in the Oval Office.

That would give the billionaire huge power and influence over the federal agencies that oversee his vast business empire. The Tesla boss says he will use whatever power he gets to push for, among other things, federal approval of driverless cars.

Crucially, Musk has the ear of the President-elect – for now at least. Trump already has done a U-turn on electric vehicles after Musk’s endorsement, and also embraced his ambitions to reach Mars with his SpaceX rockets.

But the payback may go even further. Musk has joked that he will lead a Department of Government Efficiency, or Doge – a nod to Dogecoin, the cryptocurrency he has promoted for years.

Cryptocurrency has become synonymous with the so-called ‘Trump trade’ that sent US stock markets to new peaks after his victory.

Bitcoin, the biggest cryptocurrency, hit a record high of almost $77,000 as its investors toasted his win. Trump, who once dismissed the digital token as a ‘scam’, now wants to make the US ‘the bitcoin superpower of the world’. He is even toying with the idea of creating a federal bitcoin reserve, taking the cryptocurrency into the financial mainstream.

‘Such a move would place bitcoin in a role similar to gold, giving it a historic level of legitimacy,’ said James Butterfill, at crypto asset manager CoinShares, possibly pushing its value to new highs.

For that to happen Trump would have to fire Gary Gensler, chair of the Securities and Exchange Commission (SEC), which oversees Wall Street and protects investors.

‘Trump’s stance on the SEC and Gensler has been openly critical, especially the regulatory approach to digital assets,’ said Butterfill. ‘His administration is expected to bring in leadership changes that could usher in more crypto-friendly regulators at the SEC.’

Gensler has brought many lawsuits against crypto projects for allegedly violating securities laws amid accusations from opponents that he was stifling innovation.

He argued his job was to shield consumers from collapses like the one that sunk crypto exchange FTX in 2022. Its boss Sam Bankman-Fried was jailed for 25 years for stealing $8 billion in customer deposits.

Gensler also baulked at the launch of bitcoin ETFs – exchange traded funds – which allow punters to bet on cryptocurrency without actually holdingit.The token’s spectacular gains last week were in part fuelled by inflows into American ETFs that invest in the cryptocurrency directly.

BlackRock, the world’s largest asset manager, saw its market-leading bitcoin ETF rake in more than $1.1billion on Thursday, marking the highest daily inflow since the $33 billion fund was launched in January.

How long the boom will last is anyone’s guess. Critics say Trump’s Damascene conversion to cryptocurrency and his ‘bromance’ with Musk were just part of a plan to win over young male voters and secure donations from wealthy ‘tech bros’ for his presidential bid.

If they are right and if Trump doesn’t deliver on his many promises quickly, the euphoria gripping cryptocurrency and the wider stock market will soon fade – along with the fortunes made last week.

In the meantime, you can expect a wild ride.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

This article was originally published by a www.dailymail.co.uk . Read the Original article here. .